Five Things You Need to Know About Payday Lending

Editor’s Note: This piece was originally posted on Medium on June 7, 2016 by Stop Payday Predators, a project of the Stop the Payday Loan Debt Trap Coalition, a national coalition of hundreds of groups and consumers seeking to stop the debt trap caused by payday, car title, and installment loans. CHN is a member of this coalition. Several groups from this coalition held a Congressional briefing on June 8 on the proposed rule recently released by the Consumer Financial Protection Bureau (CFPB) on payday and car title lending. For more information, see the following resources:

- CFPB Rule on Payday and Car Title Lending: What Works and What Doesn’t

- Joint Statement: Consumer, Civil Rights and Faith organizations Call the CFPB Payday Rule a Good Beginning

- Compilation of Editorials Supporting CFPB Action on Payday and Car Title Lending

- StopPaydayPredators.org, where you can submit a comment directly to the CFPB in support of a strong rule.

The payday loan debt trap is a real concern for low-income Americans, and stopping the debt trap is one way to help people out of poverty. To learn more about other ways, register to attend or watch the live-streamed event, “What Works – and What Doesn’t – to Reduce Poverty and Expand Opportunity,” June 16, 1pm ET, sponsored by CHN and others.

You probably think those “fast-cash” places are shady. Well, you’re not wrong.

Maybe you’ve seen the ads on TV, or on the side of a bus, promising “fast cash” or “money when you need it.” Payday lenders market their product as a “quick fix” for people who need a little help getting from paycheck to paycheck. But in reality, payday loans are among the most predatory forms of credit on the market, taking advantage of people who are already struggling uphill, trapping them in long cycles of debt, and extracting crazy interest rates all along the way.

On June 2nd, the Consumer Financial Protection Bureau — the consumer watchdog agency set up by Elizabeth Warren — issued long-awaited proposed rules to rein in the worst abuses of payday lenders. Here’s what you need to know about payday lending to understand exactly why strong regulations are necessary.

- Payday Loans Are Deliberately Designed as Debt Traps

Here’s how the trap works: First, payday lenders market their product as an easy, quick, and simple fix to a short-term budget gap, with “reasonable” fees. But, the catch is that borrowers have to repay their payday loan in full just weeks after they take it out (and not — like most other types of loans — in small pieces over time). Since most people who had a budget gap to begin with still have that gap a few weeks later, most borrowers end up repeatedly taking out new loans in quick succession, often using new loans to repay the old.

2. Lump Sum Repayment Is Practically Impossible for Most Borrowers, and Lenders Know It

Unlike most other forms of debt, payday loans are supposed to repaid in full just a few weeks after the loan is taken out. But for the average payday borrower, there’s almost no chance of that happening. Payday borrowers typically make less than $30,000 a year, and a $400 loan repayment would break their budget.

Of course, payday lenders know this when they issue the loans. In fact, they are counting on it. When a $400 repayment is out of the question, borrowers end up paying another $50 in fees to extend the term of the loan or take out a new loan to cover the old. And the kicker is that none of those additional fees go toward paying down the actual amount of the original loan.

3. The Fees and Interest Charges on Payday Loans Are Astounding

The typical payday borrower ends up paying more in fees than the amount of the original loan.

Most lenders charge around $15 in fees for every $100 borrowed. At first glance, that might seem comparable to something like a credit card’s rate, but it’s really not. For one thing, the term of a payday loan is often only two weeks, whereas a credit card rate is calculated over the course of an entire year. Using an apples-to-apples comparison, most payday loans carry an annual interest rate of close to 400 percent.

On top of that, while stuck in the trap of payday loans, most borrowers end up paying fee after fee after fee. All those “reasonable” fees add up pretty quickly. In fact, the average payday borrower takes out 11 loans over the course of a year, paying more than twice as much in fees as the amount of the original loan.

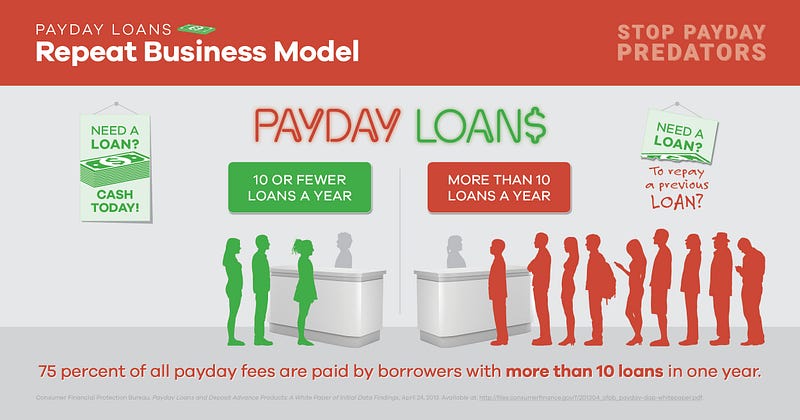

4. The Business Model of Payday Lending Depends on Trapping People

Payday lenders make nearly all of their profits from borrowers who are trapped in a cycle of seemingly never ending loans.

Not only do payday lenders understand that their product is a trap, they depend on it. “The theory in the business,” says Dan Feehan, the CEO of Cash America, “is you’ve got to get that customer in, work to turn him into a repetitive customer, long-term customer, because that’s really where the profitability is.” Feehan wasn’t exaggerating. Roughly three-quarters of all payday fees are paid by people who have taken out more than 10 loans in a single 12-month period.

5. Payday Lenders Deliberately Target Communities of Color

It’s not just about income. Payday lenders disproportionately target communities of color.

Multiple studies from across the United States have shown that payday lending storefronts tend to pop up in neighborhoods where African Americans and Latinos live. This is true even after accounting for differences in average income. A study in Florida, for example, found that even looking at only higher-income neighborhoods, payday stores were more than 2.5 times more concentrated in neighborhoods where more than half the residents were African American or Latino.

6. Bonus Thing You Need to Know: You Can Do Something About This

The rules proposed by the Consumer Financial Protection Bureau are a step in the right direction, but they certainly could be stronger. Not only that, they are just proposed rules and aren’t even final. The CFPB is currently asking for public comments on their proposed rules. We can be sure that the payday industry is throwing everything they have at the CFPB to try to weaken or undermine the final regulations. Americans who want to see a strong final CFPB rule must speak up.