Taxing the (Very) Rich: Finding the Cure for Excessive Wealth Disorder

Editor’s note: CHN Intern Sarah Morrison is a rising senior at the University of Maryland. She is studying Economics and Non-Profit Leadership.

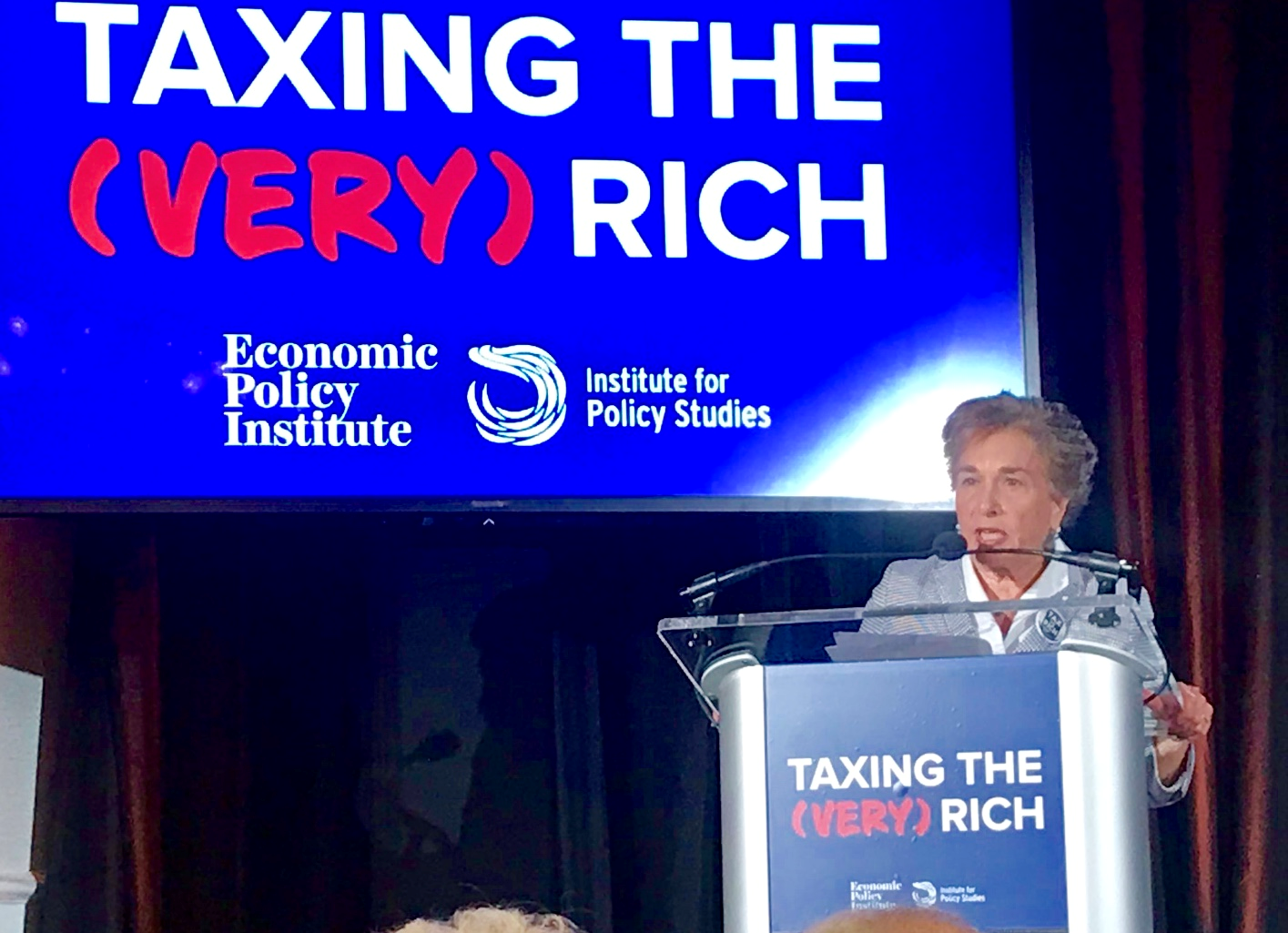

Josh Bivens (EPI) presents his introductory statements with a panel including Chye-Ching Huang (CBPP), Greg Leiserson (Washington Center for Equitable Growth), Lily Batchelder (NYU Law), and Sarah Anderson (IPS) as moderator. (Photo Credit: Michael Kink, @mkink)

Once a subject often kept behind the curtain, tax policy has quickly risen to fame recently while more political leaders discuss why tax policy has gone so wrong in our country. And this discussion appears to have led to a shift — perhaps in the direction of no longer benefitting the wealthy and corporations.

This was the overarching theme at Taxing the (Very) Rich: Finding the Cure for Excessive Wealth Disorder, the Economic Policy Institute’s (EPI) and Institute for Policy Studies’ (IPS) day-long event on Tuesday, June 25, which CHN co-sponsored. The day featured a variety of speakers and ideas, with informed policy ideas and statistics highlighting the deeply rooted causes and issues within our current tax system. Going beyond the more commonplace idea of the “top 1%” and digging into the complexities of the top 0.1%, the ultimate message of the event was clear: there is no reason why the American people as a whole should be drowning economically while the absurdly wealthy thrive on policy-encouraged greed.

One of the day’s highlights came when Josh Bivens, Director of Research at EPI, suggested a 10% surtax on incomes over $2 million. Without asking any more of the middle class, this tax could fund massive investments into child care and early education by raising $800 billion over the course of a decade. “We really should be investing in our future,” he said.

Rep. Jan Schakowsky (D-IL) explaining her fair taxation plan to ensure taxation on wealth. (PC: @mkink)

And Rep. Jan Schakowsky (D-IL) introduced her tax fairness plan, developed with Rep. Alexandria Ocasio-Cortez (D-NY), to limit the tax breaks that are given to the very wealthy. Founded on the idea that current tax policies are geared towards supporting the rich getting richer, she said that thorough changes to our tax policies seem to be the most direct way to fight inequality. Closing a number of loopholes, imposing an inheritance tax, and eliminating the special treatment of claims such as capital gains all contribute to the robust policy proposal.

Intensive policy ideas such as the two above beg the question: is this change really necessary?

In short, yes. Legitimate and foundational changes to our current tax system are necessary in every sense of the word.

The details of tax scams that allow the very rich to maintain constant, exponential economic growth — while the number of individuals who are considered low income does not improve — are obscene. Chye-Ching Huang of the Center on Budget and Policy Priorities explained that “10% of all of the U.S. labor wages go to the top 1%,” and even beyond that, much of the top 1%’s wealth stems from sources that do not show up on tax returns. This is an economic experience that seems foreign to the remaining 99%.

As for the top 0.1%, policy rooted in greed allows them to take advantage of tax exemptions with even more ease.

However, the future of tax policy is not grim. The Tax the (Very) Rich event is the perfect example of politicians, advocates, policy experts, and organizers coming together in order to effectively articulate what our country needs in order to fix its broken system. “It is important for all of us to unambivalently love taxes,” as Connie Razza of the Center for Popular Democracy stated. They fuel our economy, they benefit our working Americans, and they are currently not meeting their potential to create positive change. We don’t only need policy change, maybe we also need a broad perspective change on exactly what taxes mean in a modern society.

Jacqueline Patterson of the NAACP Environmental & Climate Justice Program discussing how the conversation cannot omit the relevance of race. (PC: @mkink)