The Big Tax Day choice: Invest in America, or let corporations and the rich off the hook

Human needs advocates, grassroots organizers, key public officials, and tax policy and other experts came together this week to promote President Biden’s plans to bring fairness and equity to the nation’s tax code.

Officially, the “Tax Fairness Day” event, which was live-streamed on Facebook, marked the May 17 deadline for Americans to file their taxes (moved back, courtesy of COVID-19). Unofficially, speakers came together to praise Biden’s proposed American Jobs Plan and American Families Plan, and the means to pay for them.

President Biden has proposed raising taxes on the wealthiest Americans and corporations by $3.6 trillion over a decade. No one earning less than $400,000 would be affected. Biden would increase the top income tax rate from 37 percent to 39.6 percent and would eliminate a loophole that allows wealthy Americans to avoid paying taxes on their wealth by passing it on to their heirs. The top corporate tax rate would rise to 28 percent and businesses would be deterred from sheltering profits offshore. And Biden would step up IRS enforcement by hiring more agents and investing in new tools and technology.

“We are at a critical juncture,” said Frank Clemente, Executive Director of the Americans for Tax Fairness Coalition, which organized and hosted the event. “We have the opportunity to finally draw down the curtain on 40 years of failed tax-cutting, trickle-down economics. It’s time to usher in a new era of tax fairness and public investment.”

Speaker of the House Nancy Pelosi joined to celebrate the short-term help in place now, and urged, “Together we must now help President Biden build an economy that works for all.”

Jared Bernstein, a member of President Biden’s Council of Economic Advisers, explained that the U.S. through the years has evolved toward a less fair tax code and a diminished tax base. He said not only has the federal tax system been collecting less revenue than fiscal sustainability requires, but it has come to favor wealth over work, with wealth, not earnings, dominating the high end of the economic scale.

Bernstein pointed to three disturbing trends that demonstrate the need for Biden’s proposals.

First, he said wealth has become increasingly concentrated in the U.S. in recent decades. The share of wealth held by the top 1 percent is roughly the same as the share of wealth held by the bottom 90 percent. And white families have about eight times the wealth of black families and five times the wealth of Latinx families.

Second, Bernstein said increasingly concentrated wealth is rewarded by the current tax code. And third, he said there are two ways the tax code favors wealth over earnings. One way is through favorable tax rates – the top rate for capital gains and dividends is 20 percent while the top rate for earnings is 37 percent. A second way is that for the majority of American households, income comes from earnings and whatever wealth exists comes from savings families have been able to put aside. Families live from their paychecks and not from stock portfolios, while the wealthiest Americans derive their income from non-labor sources.

John Anzalone, a longtime pollster who worked for Biden during the 2020 campaign and still polls for him, said public opinion on tax issues has reversed itself from where it was 40 years ago and even more recently. He said Democrats are no longer on the defense when it comes to taxes.

In fact, Anzalone said, every focus group on the topic he has conducted in the past five years has featured middle class families saying their work is not valued in today’s economy and they take on a share of the tax burden that should be borne by corporations and the wealthiest Americans.

“The American people are pissed off and they’re with us on the diagnosis that they take too much of a burden and those at the top don’t take enough,” Anzalone said. “And the fact is, we see this in the public polling and the polling we do internally. We see that a super majority of people support increasing corporate taxes. And we see two-thirds of Americans supporting increasing taxes on those people making over $400,000. And we also see two-thirds of people in America supporting increasing the corporate minimum tax and closing loopholes that allow the wealthy and big corporations to avoid or skirt their obligations.”

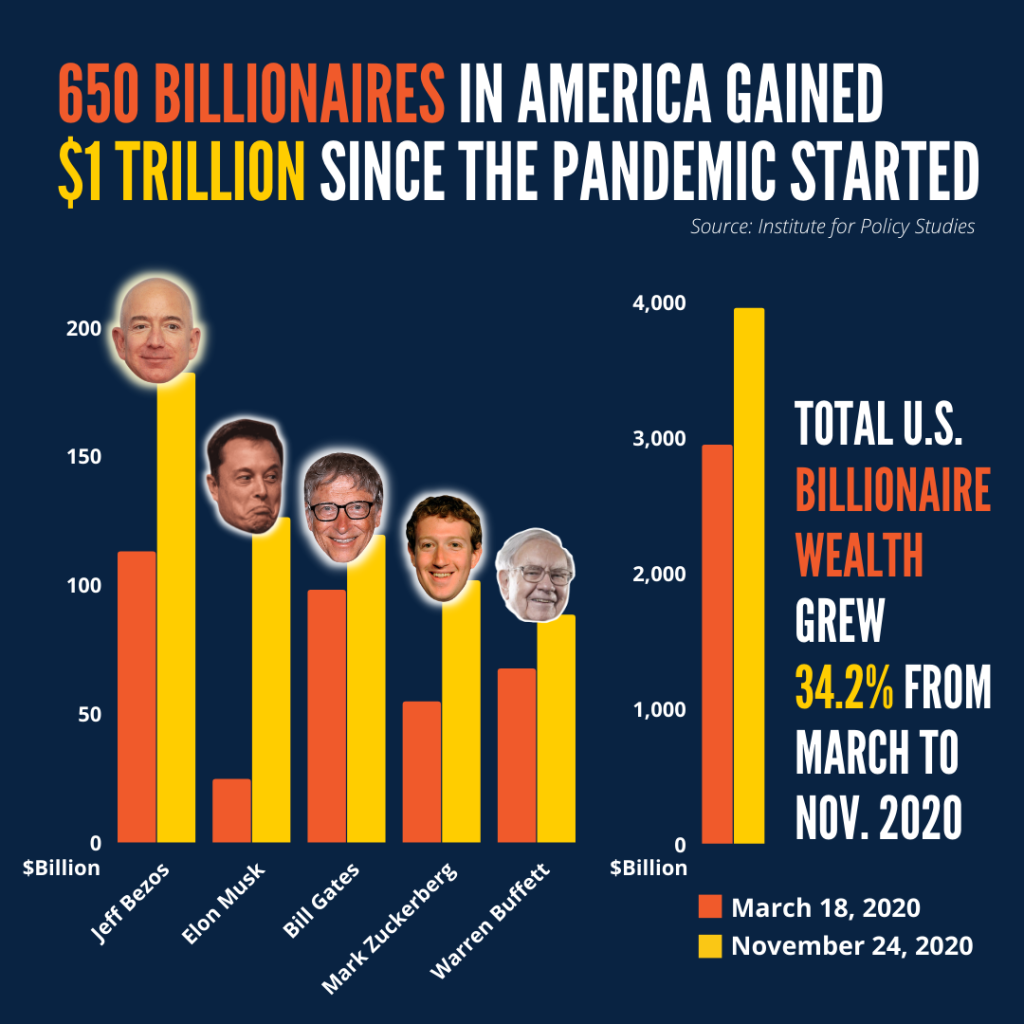

Chuck Collins, Director of the Program on Inequality and the Common Good at the Institute for Policy Studies, said U.S. billionaires in particular have consolidated their wealth during the past 14 months of pandemic. “Since March 2020, the total combined wealth of U.S. billionaires has increased $1.6 trillion, an increase of 55 percent” he said. “The pandemic concentration of wealth is staggering. Since 1990, a full third of the billionaire wealth gains have occurred during the past 14 months of the pandemic.”

A number of speakers linked reforming the tax code to a social justice movement aimed at addressing racial and other forms in inequity.

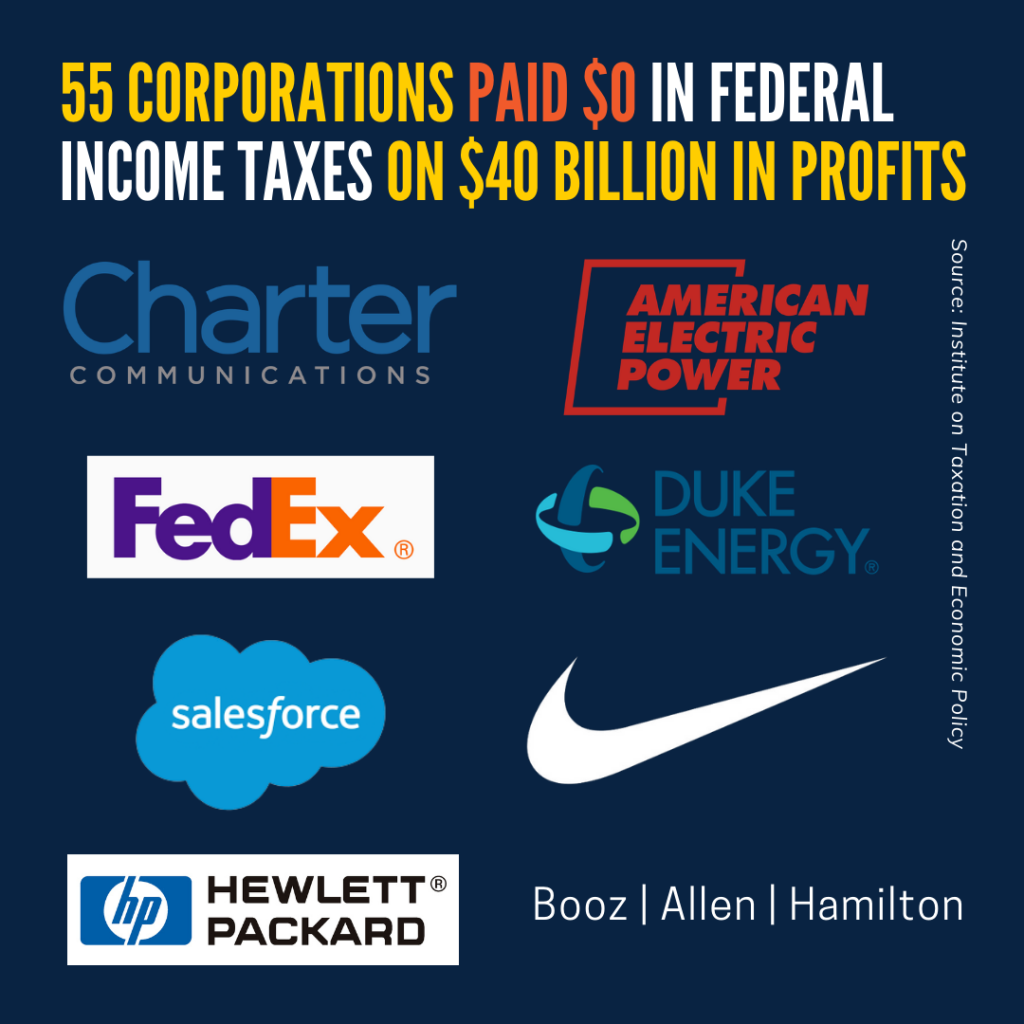

“It is so affirming to be talking to people who want tax justice because we are never going to get racial justice, we are never going to get economic justice, we are never going to get climate justice without first getting tax justice,” said Amy Hanauer, Executive Director for the Institute on Taxation and Economic Policy. “And the way that we’re going to do it is by having corporations and wealthy people pay their fair share. That’s how we’ll fund the kinds of communities we want, provide the support for families, and take on the challenges of inequality and climate chaos that are haunting us in 2021.”

Janet Marguia, President of UnidosUS, said Latinx people earned more than $1 trillion and paid more than $250 billion in taxes in 2017 alone. “But this has not resulted in equitable opportunities to build well, even in 2019 (before the pandemic),” she said. “When Latino household income was at an all-time high, Latino households only earned 74 cents to every one dollar earned by white households. A fair tax code that works for Latino families is critical for ensuring families can build their American dreams, now and into the future.”

Fatima Goss Graves, President and CEO of the National Women’s Law Center, noted that women of color – and women in general – have been disproportionately affected by COVID-19 and the recession it left behind. But she also noted that women were struggling before COVID-19 ever landed.

“It’s not enough to go back to where we were in January of 2020,” she said. “We need large-scale public investments to put us on a path to shared and sustainable prosperity. The Biden Administration makes historic investments in the care infrastructure that makes all other work possible, including child care, paid leave, and home- and community-based supports. These investments will ensure that families can care for their loved ones and that the women who do this work are paid living wages.”

Many speakers praised the proposals to continue expansions of the Child Tax Credit, the Earned Income Tax Credit, and the need to permanently support funding for child care and health care, particularly for low-income Americans.

Amy Adams, representing the Iowa Citizen Action Network and Iowa Tax March, said that as a parent of three children, she is particularly excited about the expanded Child Tax Credit, which will result in monthly payments to many parents beginning July 15.

“Currently, tax credits are tied to refunds that occur once per year,” she said. “Under Biden’s plan, this credit would be delivered regularly. As parents, we all know about those unwanted expenses. Whether it’s a trip to the doctor’s office, a trip to the dentist’s office, money for a class field trip, or buying groceries or simply putting a meal on the table. We know that when this money is delivered regularly, it will have a greater impact on families. Not just a once-per-year tax refund.”

Julie Groce, a parent, elementary school teacher, and MomsRising member, lived with her husband in Arizona when the pandemic hit. Her son’s child care center shut down, and she struggled to meet his needs while also teaching her students remotely. “I wasn’t able to do my job as well as I wanted and I wasn’t able to be the mom I wanted to, and that was awful,” she recalls.

Julie and her husband moved to Grand Blanc, Michigan, to be closer to family. She was thrilled to be hired once again as an elementary school teacher. “But trying to find a child care program, that was a nightmare,” she said. “So many child care centers didn’t get the support they needed to weather the pandemic, forcing them to shut down. In some cases, it was a permanent shutdown.”

Eventually, Julie and her husband, who works in IT, did find child care for their son. “We eventually did find a fantastic program, but we’re paying through the nose and it’s a huge financial burden on us,” Julie said. “And I don’t know how families like mine are going to make it unless we make child care more affordable in this country.”

Laura Packard, health care activist and founder of Health Care Voices, notes that Biden’s proposals include making care more affordable for more Americans under the Affordable Care Act.

“Four years ago, I walked into my doctor’s office with a nagging cough and walked out with a Stage IV cancer diagnosis,” Laura said. “I’m in remission today thanks to the care I received that I was able to pay for through the Affordable Care Act. The ACA makes benefits for affordable for millions of Americans. We need to pass the American Families Plan now to make sure those benefits are permanent and that every American who needs health care is able to get it. We need to tax the rich and corporations to help pay for the health care that every American needs and deserves.”

Deborah Weinstein, Executive Director of the Coalition on Human Needs, framed the debate facing Congress as a “big Tax Day choice.”

“Invest in our children, our workers, our future – or forget that, and let corporations and the rich keep on paying far less than their fair share. How hard a choice is that?” she asked.