The color of money

Editor’s note: CHN Intern Sarah Morrison is a rising senior at the University of Maryland. She is studying Economics and Non-Profit Leadership.

“The problem with democracy, is that it has not yet been tried.”

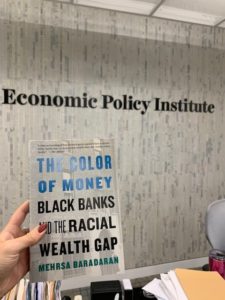

This was the W.E.B. Du Bois quote that Mehrsa Baradaran employed to end her presentation at a recent Economic Policy Institute event, The Color of Money with Mehrsa Baradaran. She followed up, grinning triumphantly and sharing her sentiment that maybe it’s about time to give real democracy a try.

Baradaran herself, a well-known author and law professor who focuses on banking, had the crowded room captivated throughout her all-encompassing presentation. She is currently teaching at the University of California, Irvine, Law School, and engaging her following on racial banking issues.

Her most recent book, The Color of Money: Black Banks and the Racial Wealth Gap is, in short, stunning.

Entirely comprehensive, it connects the historic dots that reinforce the wealth gap we currently observe, but many of our nation’s policies ignore. At the beginning of Reconstruction in 1865, blacks owned 0.5% of the nation’s wealth. Fast forward to 2019: blacks still only have 1%.

That is in no way acceptable.

Baradaran expertly explained how discriminatory policies over time created a culture in which blacks were oppressed with little to no opportunity for upward mobility. From clear and obvious Jim Crow laws to subliminally biased campaign messages from rising politicians, the black population in the U.S. has never received the justice that it deserves. As she said of colonial abuse of the African American population: “The entire southern economy was based not only on the capital created by the slaves, but the capital of the slaves themselves.”

Racism remains a prevailing force in our country, as she made clear in her presentation. The value of property in black and brown areas is automatically lower. Poor equity in black homes is entirely brushed under the rug by labeling the area as “a bad neighborhood” or saying the neighborhood has “poor schools.”

So the question is: if this issue is so deeply ingrained in American culture, how do we solve it?

According to her, it should not be nearly as difficult as politicians make it out to be. Many in the past have used the ideas of black banks and black commerce as campaign promises, without ultimately promoting accompanying legislation. From the Nixon campaign to now, the book highlights these empty promises.

Baradaran says the wealth gap should be relatively simple to solve – if we give it our best effort. Suggesting policies such as reparations and a reinforced push for equitable banking systems, she seemed optimistic. After all, policy matters, and we know from history that serious legislation can have positive and profound consequences. Think of the New Deal. Think of the Great Society.

But the key word here is effort.

It is past time that our elected officials begin focusing on an issue that they have all but ignored since the beginning of our nation — the racial wealth gap. If there is anything that Baradaran can teach us, it is that this inequity was intentional.

We can no longer accept it. Maybe it is time to try a little democracy.