The House bill to slash basic needs: Call your Rep, spread the word, and don’t let up.

Editor’s note: Based on remarks by Deborah Weinstein, CHN’s Executive Director, during the Virtual Rally reaching thousands of people, 5/19/25.

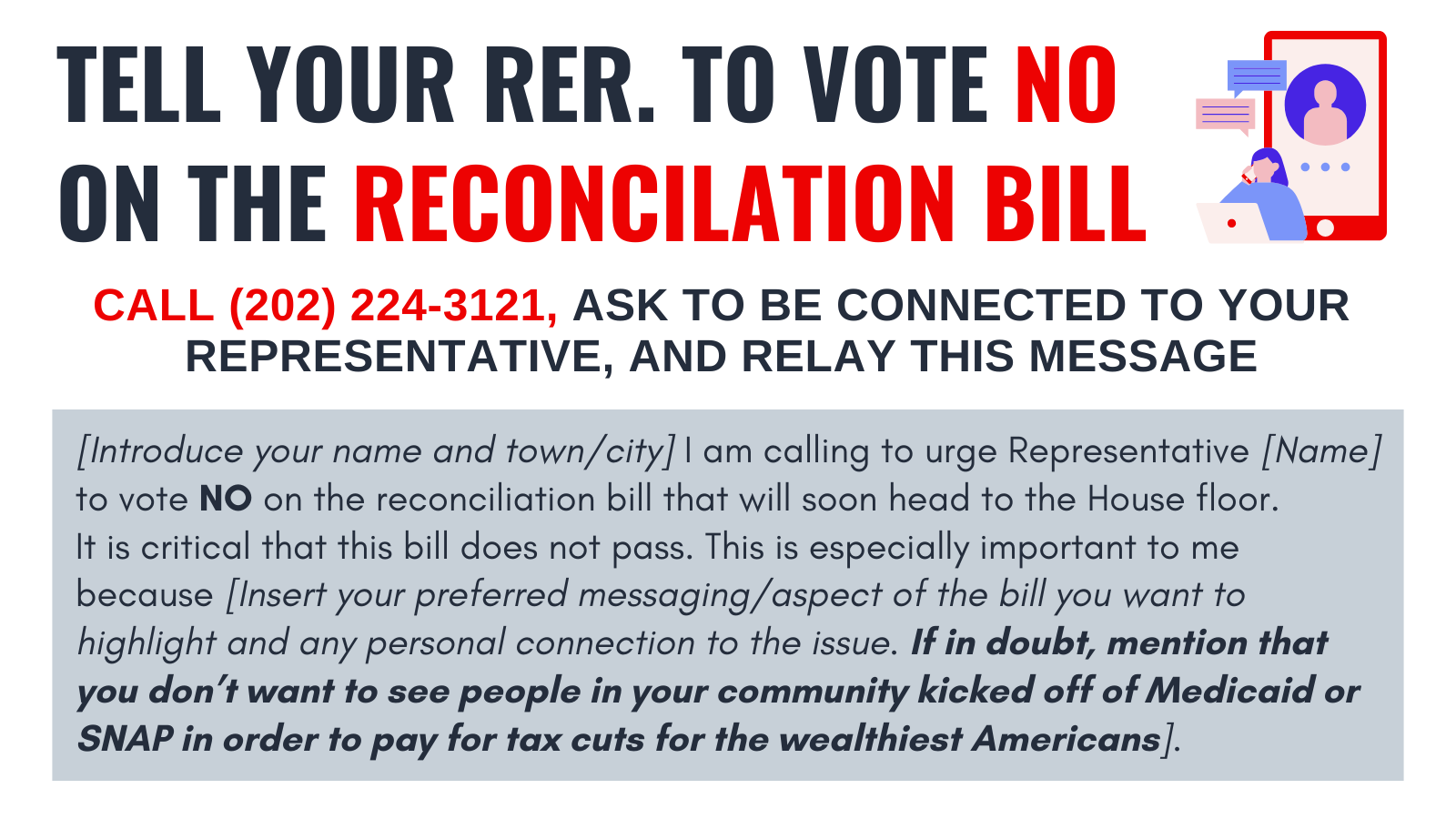

Here’s what the House budget bill does: If you have $4.3 million or more in annual income, next year you’ll gain an average of $390,000 in tax breaks. If you’ve got less than $17,000 in annual income, your income will go down $1,035. We have to say no – and you’re needed to call your Representative today – Tuesday, May 20 and after: urge them to VOTE NO on the House budget bill: (202) 224-3121.

Why this inequity? The Penn Wharton Budget Model (table 5) has combined the impact of the proposed tax changes and program cuts. They show losses for people in the bottom two-fifths of the economy because people with low incomes get little out of the tax breaks and face recklessly huge cuts to basic needs programs, especially health care and nutrition. This model talks about the dollars lost, but that’s not the whole story. Those funding cuts mean people will go without nutritious food and doctor visits, getting sicker, less able to work and to care for children or other family members. These losses not only affect individuals and families. According to the Commonwealth Fund, an earlier estimate of the cost of the health care and nutrition cuts before the House would result in the loss of 1.3 million jobs over the next decade.

Despite trillions in tax breaks for the rich and corporations, the bill will let one tax credit expire: an expanded tax credit for Affordable Care Act health insurance premiums, making insurance unaffordable for around 4.2 million people, undoing important progress in covering more low wage earners. Other ACA restrictions are expected to drop another 1.8 million.

As for Medicaid, at least 7.6 million people would be expected to lose benefits because of work reporting rules and other restrictions. The bill even cuts Medicare, breaking repeated promises not to do that – some poor older adults won’t get Medicaid help to pay for Medicare premiums, and the bill suddenly denies Medicare to legal immigrants who have followed the rules, worked, and paid into Medicare, usually for decades.

SNAP nutrition aid as well as Medicaid will drop people with very low incomes who don’t meet work reporting requirements, which will apply to more people. But the real problem is that millions of people will lose assistance simply because they cannot get through to the bureaucracy to satisfy the paperwork requirements. We have repeatedly seen eligible people lose Medicaid and SNAP because of red tape – wrong addresses, inability to get through to call centers, language problems, not having the right documents. They may be working, or they may be exempt, because of a disability, but they can’t get through to prove it or don’t know they have to. Many states, reeling from billions in additional costs thrust on them, will not make any of this easier.

Far from encouraging or helping low-income workers, this bill hits them and their children hard – new co-pays for Medicaid care for the low-income people added in most states through the Affordable Care Act’s Medicaid expansion, other Affordable Care Act cuts, likely reductions in care for people with disabilities, denying the Child Tax Credit to millions of children in low-wage families, so much, so life-threatening, so mean. Call your Rep, spread the word, and don’t let up.

Sources for Medicaid and ACA impact estimates: Center on Budget and Policy Priorities Health “By the numbers” Policy Brief; National Health Law Program, Top 10 Reasons Why House Republicans’ Reconciliation Bill is Bad for Medicaid (and the ACA).

Source for SNAP impact estimates: Center on Budget and Policy Priorities, SNAP “By the numbers” Policy Brief.