The House Republicans’ Budget Bill Guts Basic Needs Programs for the Most Vulnerable Americans to Give Tax Breaks to the Rich

Blog post by Center for American Progress, a member of CHN

Editor’s note: This piece was first published by the Center for American Progress (CAP) and was updated on May 20, 2025. It was written by Bobby Kogan, CAP’s Senior Director or Federal Budget Policy. CAP is a member of the Coalition on Human Needs.

Updated, May 22, 2025: The House Republicans’ budget bill was passed by a one-vote margin (215-214) on May 22, 2025.

Earlier today, House Republicans unveiled the final parts of their partisan tax and budget bill. Their proposal would dramatically reshape America for the worse: It would implement the largest cuts to both Medicaid and the Supplemental Nutrition Assistance Program (SNAP) in history—kicking millions of Americans off their health insurance and taking food away from hungry children. It would raise household electricity costs while trapping most middle-class and poor students in greater student loan debt to afford a higher education. And it would make all these changes as a means to partially offset tax breaks that disproportionately go to the richest Americans, giving households in the top 0.1 percent a multihundred-thousand-dollar tax break on average while increasing deficits by trillions of dollars. Taken as a whole, the bill would add trillions of dollars to structural deficits despite these enormous cuts to critical services.

If enacted, this would be the largest transfer of wealth from the poor to the rich in a single law in U.S. history.

The largest Medicaid cuts in history

More than 1 in 5 Americans rely on the Medicaid program to cover their health care needs. The House Republican plan calls for at least $600 billion in cuts to Medicaid and the Children’s Health Insurance Program (CHIP), predominantly from Medicaid. These would be the largest cuts to the Medicaid program in history by many hundreds of billions of dollars and, according to the nonpartisan Congressional Budget Office (CBO), would rip health insurance away from more than 8 million vulnerable Americans.

The plan calls to institute work requirements on many Medicaid enrollees. In reality, these are work “reporting” requirements that institute paperwork requirements that end up keeping people who meet the requirements off of Medicaid. Every attempt at implementing work reporting requirements to date has led to catastrophic results: massive coverage losses, including among people who are working, because of needless red tape—without actually encouraging work. It is worth noting that the only way to achieve savings through this method is for people currently using Medicaid to lose coverage. In addition to cutting thousands of lives short each year, these losses have significant ripple effects.

Unconscionably, the Republican plan would also bar people who fail to meet Medicaid work reporting requirements from getting financial help to buy insurance on their own through the ACA marketplaces—effectively sentencing people who either cannot meet the requirements or cannot make it through the red tape to prove they are working to have no affordable options for health insurance at all.

When millions of people lose coverage, uncompensated care costs increase and harms economic activity. Rather than incentivizing work, this combination kills jobs. The Commonwealth Fund estimates that onerous work requirements for Medicaid coverage could result in the loss of nearly 450,000 jobs. Unsurprisingly, nearly half of those job losses would hit the health care sector.

Even worse, work reporting requirements can trap sick people by making it more difficult for them to obtain the medical care that they need to return to work and qualify for Medicaid in the first place.

The plan also calls for states to impose mandatory federal minimum out-of-pocket costs on Medicaid enrollees above 100 percent of the federal poverty line. This is an especially punitive way to reduce spending by basically limiting a person’s ability to get the care they need even when they have Medicaid. Research shows that even small cost-sharing requirements of $1 to $5 can stop low-income people from seeking necessary medical care. While states currently have the option to charge very nominal copays for non-emergency care for some enrollees, requiring that low-income people pay added costs for doctor visits or prescriptions can mean forcing them to choose between health and other basic needs.

The hypermajority of these cuts cannot be credibly construed as even pretending to address fraud. These cuts come predominantly from making it harder for eligible people to enroll in or maintain their coverage, from reducing money to states to cover currently eligible people, or from imposing new costs on Medicaid enrollees.

The largest SNAP cuts in history

Around 1 in 8 Americans receives nutrition assistance through SNAP. The program is a particularly crucial lifeline for hungry children: Nearly 62 percent of SNAP households have children. SNAP benefits are already meager at a little more than $2 per person per meal. The House Republican plan calls for cutting SNAP by more than $290 billion, close to 30 percent. This would be the largest SNAP cuts in history by far, which would result in food being taken away from the hungry.

The House Republican plan would fundamentally rework SNAP by shifting costs to states, leaving them responsible for funding a meaningful portion of the program. This massive shifting of costs to states could force states to make painful cuts to programs that meet people’s basic needs, such as education and public safety. This would be particularly acute during recessions, when state revenue declines but SNAP needs increase. The language of the bill is unclear, but it’s possible that SNAP assistance would end entirely if a state is unable or unwilling to meet its newly assigned portion of the cost.

Additionally, superfluous paperwork requirements that target older Americans and families with children are particularly incongruous with the goals of SNAP, as food assistance is intended to keep families afloat when a family member loses a job. SNAP is among the economy’s strongest automatic stabilizers in times of economic downturns, as it quickly injects support for a family’s most immediate needs and is spent in the local community.

The plan also proposes to block future administrations’ ability to implement benefit adjustments under the Thrifty Food Plan. This could allow the value of SNAP to erode over time, just as it did for roughly 50 years before an update in 2021 increased benefits to reflect the current cost of a healthy diet. Without future ability to do a similar update, this could continually cut nutrition for all recipients as the standards used to calculate benefits become more outdated.

None of these cuts can be credibly construed as reducing fraud. Instead, they will deliver less nutrition assistance to hungry people who meet the current eligibility requirements of SNAP and increase administrative costs.

Higher electricity costs

Wind, solar, and batteries added over 90 percent of new generation capacity to the grid last year, thanks to falling costs. The House Republican bill would start cutting federal investment in building these crucial energy sources, undermining not only wind and solar, but also new battery storage, geothermal, hydropower, nuclear, and any other clean energy technology at a time when electricity demand is increasing. Fossil fuels, meanwhile, would continue to receive billions in subsidies, even though they are a volatile source of energy that is vulnerable to manipulation by cartels and undemocratic governments and cause terrible harms to the climate and public health.

The result is that the U.S. will build significantly less wind and solar over the next decade, adding to annual household electric utility bills. These newly imposed costs will be exacerbated as, at the same time, the administration is canceling programs such as Energy Star that let consumers know which appliances are the most energy efficient. In addition, the House Republican plan calls to eliminate tax credits for home energy efficiency improvements.

Spending more on travel

The House Republican tax bill will take away support from households who are trying to afford an electric vehicle (EV). The repeal of clean vehicle and energy credits, alongside rollbacks in clean vehicle standards, will cause the families to spend hundreds more at the gas pump every year—a windfall of tens of billions of dollars in additional revenue for the oil companies over the next 10 years.

Not only does this bill cut out the financial support that makes new and used cars more affordable, but it also it adds an extra $250 annual fee on people who already own an EV and $100 for hybrid car owners.

Higher cost of financing college

Roughly 1 in 8 Americans have federal student loans, with an average monthly payment of almost $400. The House Republican plan increases costs for students in several ways: It eliminates subsidized loans for undergraduates, requiring students to pay interest on loans that accrues while they are in school; introduces new and updated repayment plans, which increase payments for the lowest-income borrowers; and changes enrollment requirements for Pell Grants that would force recipients to take on more courses or see reduced award levels up to $1,500 annually. Overall, this legislation cuts around $350 billion for federal programs that help to make higher education more accessible and affordable.

Tax breaks for the rich

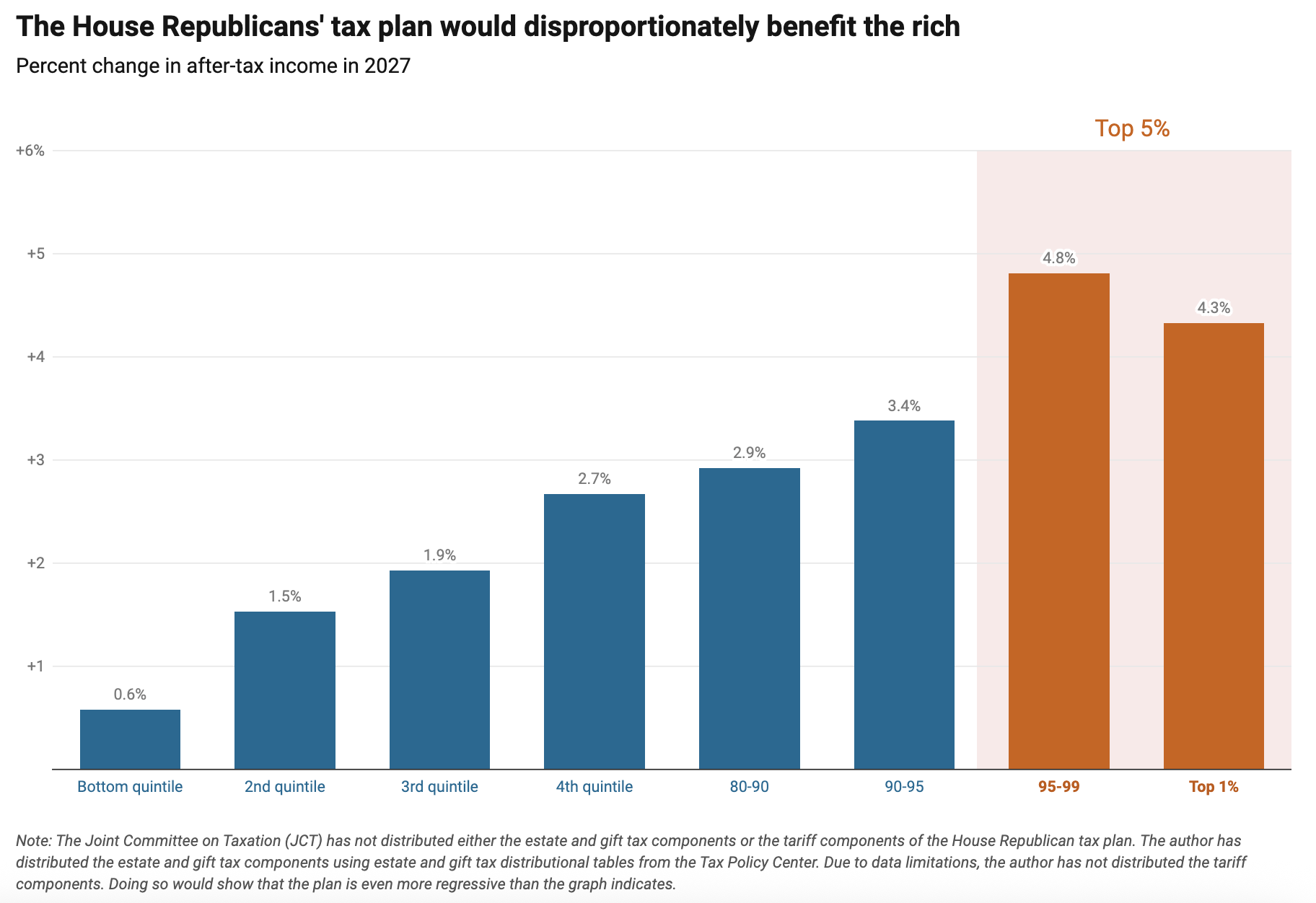

Significant portions of the 2017 Trump tax law are set to expire at the end of 2025. House Republicans are seeking to extend most of the expiring parts of this law. This would give millionaires a $68,000 tax cut and give households in the top 0.1 percent a $300,000 tax cut while raising taxes or doing nothing for 33 million working-class households.

The plan calls to further expand the pass-through deduction from 20 percent to 23 percent. This provision has no legitimate conceptual justification and is a giveaway to S corporations, some private equity, and some hedge funds. It also calls to further increase the estate and gift tax limit to $30 million for married couples—a windfall for wealthy heirs.

The House Republican plan also creates a new mechanism to avoid capital gains—while funneling federal tax dollars to schools without any control over the quality of the institution.

And many of the new provisions ostensibly for lower-income Americans leave out the most vulnerable. The plan calls for a temporary increase in the child tax credit but does so in a way that entirely leaves out poorer children. Worse, the plan calls to change eligibility to exclude families where one of the parents is undocumented (unless the parents are unmarried). This would punish children. The plan also calls to temporarily end the taxation of tipped income. This plan is poorly targeted and makes no sense as tax policy, setting up a system that allows servers and barbers to pay lower taxes than a teacher who earns the exact same wage. It also allows for heavy gaming of the tax write-off. The plan also calls to temporarily lower taxes for some elderly Americans. However, the approach taken is so poorly targeted, it would do nothing to help most poor, elderly Americans.

These tax policies would cost $3.8* trillion and would give larger tax cuts to the richest Americans than any other income group.

In order to conceal the true cost of these policies, the House plan calls to turn many of these policies off. Official cost estimates from the CBO and the Joint Committee on Taxation (JCT) project the budgetary impact of policies over the “budget window”—in this case, through 2034—but House Republicans have called to turn off many of these policies after a few years in order to pretend these policies cost less than they do.

In total, the official JCT cost estimate of the tax provisions indicates these tax policies would cost $3.8 trillion over the course of the decade. However, if these policies are extended when they expire—just as Republicans are trying to extend their last set of temporary tax cuts—the tax cuts would total roughly $5.3 trillion.

If enacted, this would be the largest transfer of wealth from the poor to the rich in a single law in U.S. history.

Conclusion

Taken as a whole, this bill would harm Americans—particularly the most vulnerable people—and leave the country worse off. It would lead to preventable deaths by taking health care away from millions of people. It would worsen food insecurity by taking food away from the hungry, particularly kids. It would leave the United States on a significantly worse fiscal trajectory by adding trillions of dollars to structural deficits. Budgets showcase our morality because they force governments to decide how to prioritize limited resources. The House Republican budget plan would shift funding away from the sick and hungry and, instead, toward the wealthiest Americans.

The author would like to thank Alexandra Cogan, Amina Khalique, Andrea Ducas, Benjamin Verdi, Bill Rapp, Chester Hawkins, Colin Seeberger, Daniella Leger, Debu Gandhi, Doug Molof, Drew McConville, Emily Gee, Jamie Perez, Jared Bass, Jenny Rowland, Joe Radosevich, Kennedy Andara, Kyle Ross, Laura Rodriguez, Leo Banks, Lily Roberts, Lucero Marquez, Madeline Shepherd, Mimla Wardak, Mona Alsaidi, Natalie Baker, Natasha Murphy, Navin Nayak, Ryan Koronowski, Sage Warner, Sam Signorelli, Sara Partridge, Sarah Nadeau, Shannon Baker-Branstetter, Sophia Applegate, Sophie Cohen, Trevor Higgins, Weadé James, Will Beaudouin, and Will Ragland.

The positions of American Progress, and our policy experts, are independent, and the findings and conclusions presented are those of American Progress alone. American Progress would like to acknowledge the many generous supporters who make our work possible.